A long-simmering dispute over who controls two container ports at opposite ends of the Panama Canal is rapidly turning into a broader geopolitical clash between Washington and Beijing. What was once a legal and commercial disagreement is now emblematic of how the U.S.–China rivalry brings renewed attention to the Panama Canal, one of the world’s most vital trade corridors.

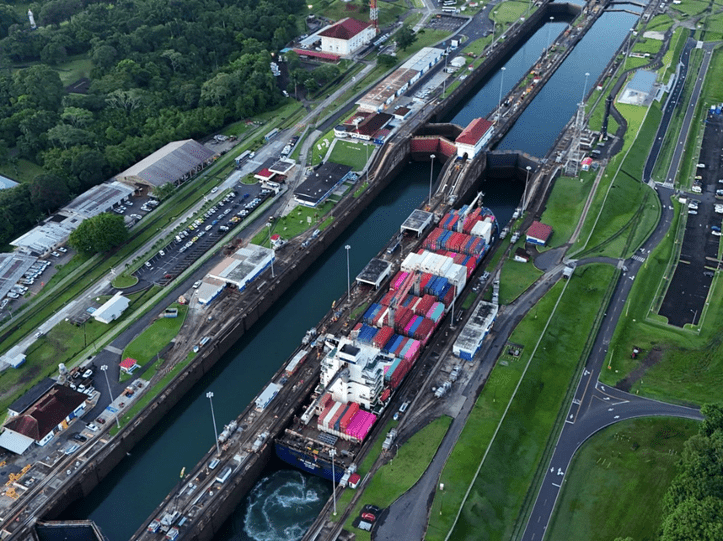

The tensions intensified after Panama’s highest court struck down the operating license of a subsidiary of Hong Kong–based conglomerate CK Hutchison, which had been managing two critical terminals along the canal. The waterway is essential to global commerce, carrying roughly 40% of all U.S. container traffic each year, making the ruling far more than a local legal matter.

A Court Ruling With Global Implications

The decision was widely interpreted as a strategic win for the United States, which has increasingly prioritized limiting China’s influence over key infrastructure nodes tied to global trade. For Washington, the Panama Canal is not just an economic artery but a strategic chokepoint with direct implications for national security and supply chain resilience.

Beijing, however, reacted sharply. In one of its strongest responses yet, China warned that Panama would “pay a heavy price politically and economically” unless it reversed course. China’s Hong Kong and Macao Affairs Office dismissed the ruling as “logically flawed” and “utterly ridiculous,” underscoring the depth of its frustration.

Panamanian President José Raúl Mulino pushed back forcefully. He rejected Beijing’s warnings and emphasized that Panama operates under the rule of law, stressing that judicial decisions are independent of political influence. In his view, the court’s ruling was a domestic legal matter—not a geopolitical maneuver.

Legal Battles and Long-Term Fallout

CK Hutchison has not accepted the ruling quietly. The company confirmed it has taken Panama to international arbitration, saying it strongly disagrees with the court’s determination. Analysts expect the legal and political fallout to stretch on for years.

According to Scott Kennedy, a senior advisor at the Center for Strategic and International Studies, the dispute is less about port management and more about influence. He described it as a contest for dominance in Latin America, predicting prolonged legal fights across multiple jurisdictions alongside heavy political and economic pressure from both Beijing and Washington.

These tensions are unfolding against a backdrop of already strained U.S.–China relations. Trade disputes, tariff wars, export controls on rare earths, disagreements over Taiwan, China’s support for Russia in the Ukraine war, and U.S. military actions in regions such as Venezuela and Iran have all contributed to a deteriorating relationship.

China Signals Economic Pressure

The stakes rose further after reports suggested China had instructed state-owned firms to pause discussions on new projects in Panama. Shipping companies were also encouraged to explore alternative routes, while Chinese customs authorities reportedly prepared to intensify inspections of Panamanian imports, including agricultural goods like bananas and coffee.

At the same time, CK Hutchison’s previously announced $23 billion deal to sell its non-Chinese port assets to a BlackRock-led consortium has come under scrutiny from Beijing. Chinese officials criticized the deal as yielding to U.S. pressure and pushed for changes, including subjecting it to China’s merger review process and potentially bringing in state-owned shipping giant Cosco as a partner.

Despite these moves, analysts believe China’s response will remain measured. Jack Lee of China Macro Group noted that while Beijing wants to signal disapproval, it is unlikely to force Panama to reverse its decision—especially given how strategically important the canal is to U.S. interests. The episode, he added, highlights China’s vulnerability in protecting its overseas economic interests when faced with coordinated U.S. pressure.

Maritime Power and Strategic Chokepoints

Beyond Panama, China has steadily expanded its footprint in global maritime infrastructure, particularly across Latin America. A notable example is Peru’s Port of Chancay, majority-owned and operated by Cosco, which is expected to significantly reduce shipping times across the Pacific.

U.S.-based analysts warn that China’s reach across the maritime sector is extensive. The country controls or operates more than 100 overseas ports worldwide, dominates global shipping container manufacturing, produces the majority of ship-to-shore cranes, and commands a significant share of global shipbuilding orders. With roughly $270 billion in cargo moving through the Panama Canal each year, any expansion of Beijing’s influence in this space raises concerns about strategic dependency.

A Call for a Multipolar World

As the standoff continues, global leaders are voicing concern about the broader implications of an escalating U.S.–China rivalry. United Nations Secretary-General António Guterres recently warned that global challenges cannot be solved by a single dominant power—or even by two competing ones.

He argued that lasting peace, sustainable development, and shared prosperity require a multipolar world where influence is more evenly distributed. In that context, the Panama Canal dispute serves as a powerful symbol of how infrastructure, law, and geopolitics are increasingly intertwined—and how the balance of global power is being tested in unexpected places.